Motivation

We propose the adoption of a new price impact model for Jupiter: the Additive on Imbalance Model. This is an expansion of the mechanism design considerations following the new Price Impact Parameter Recommendations. This mechanism addresses critical shortcomings in Linear Price Impact Models, particularly its vulnerability to trade splitting and its inability to scale with market imbalance. The newly implemented model preserves user experience for small trades while improving protection against manipulation tactics.

Limitations of the Linear Model

The Linear Model calculates price impact as a flat function of trade size, without regard for the system’s directional imbalance. This creates a significant exploit vector: Trades can be split into smaller fragments to bypass price impact.

Because the linear function resets for each individual trade, a large trader can divide a single high-impact transaction into multiple low-fee trades. This defeats the intent of price impact altogether, allowing directional risk to accumulate without a corresponding cost. The result is a mechanism that lacks economic teeth and creates inconsistent penalties for equivalent market effects.

This loophole poses a systemic risk to the protocol during periods of rising open interest imbalance, when efficient disincentivization of further skew is most critical.

Introducing the Additive on Imbalance Model

The Additive on Imbalance Model retains the intuitive base of the linear approach while introducing a dynamic penalty layer that scales with the system’s imbalance.

Core Design

- Linear Base: For imbalances below a defined threshold, fees follow the same linear behavior as the prior model.

- Additive Penalty Beyond Threshold: Once the delta imbalance exceeds a specified threshold, an additional fee is applied:

PenaltyFee = factor * (newImbalance / Threshold) ^{exp}

So the total fee to be paid, using the linear model until the threshold and the additive penalty above it is:

Total Fee = Min\{[(Base~Fee + Trade~Size / Trade~Impact~Fee~Scalar) + (factor * (newImbalance / Threshold)^{exp}],Max~Fee\} *10000 - Smooth Curve: The penalty is designed to scale gradually, rather than spike sharply. This leads to fairer treatment of trades across all sizes.

Example Behavior

- A $1,000 trade during high imbalance, e.g., $8M+, begins to incur gradually increasing fees.

- Small trades are not penalized harshly under normal conditions.

- The parameter

expgoverns how aggressively the penalty grows past the threshold, andfactorcalibrates the magnitude.

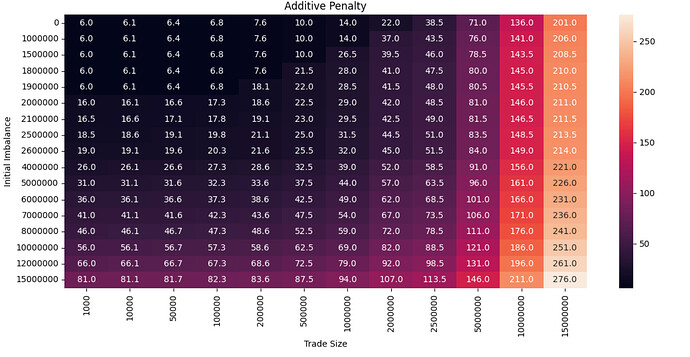

Below is a heatmap demonstrating the Additive Penalty with factor = 10 exp = 1.2. Note that the Trade Size represents the total amount of trades executed within the time window in order to prevent trade splitting.

Note the $1,000 trade size column. Even if one splits trades, they will start paying higher fees when the imbalance is high. Also note that there is no “max price impact” here, but it could still be added to avoid the high fees after $8M imbalance.

The parameters can be further adjusted to create a less severe price impact on small trade sizes. The following parameters are used to generate the below heat map:

factor = 1e-3 exp = 1

Benefits

- Trade Splitting Resistant: Fee accumulation makes it inefficient to circumvent costs by slicing trades.

- Retail-Friendly: Maintains low cost for average trade sizes seen in Jupiter markets.

- Dynamic Risk Pricing: Fees scale meaningfully during stress, improving systemic integrity.

- Customizable: The model can be tuned (e.g., through

factor,exp, or cap limits) to reflect changing market conditions or governance objectives. The currentmax_fee_bpscan be set, capping the price impact at times of extreme demand.

Summary

The Additive on Imbalance model delivers a substantial upgrade over the linear model by introducing imbalance sensitivity while preserving simplicity and efficiency for users. This approach better aligns fee logic with the protocol’s risk posture and user incentives, offering a more robust foundation for long-term sustainability.

We welcome feedback and discussion from the community on the implementation and parameter tuning.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0