Summary

Chaos Labs recommends increasing the tradeImpactFeeScalar 3x per asset and the maxPositionSizeUsd 2x per asset and running this configuration for a two-week test period. After the test period, results will be evaluated to determine whether to keep the new parameters or make further adjustments.

Introduction

Jupiter is working to make its fee structure more competitive and attractive to traders. As part of this effort, Chaos Labs recommends adjusting key parameters, specifically increasing the tradeImpactFeeScalar and the maxPositionSizeUsd. These changes are intended to lower users’ effective trading costs while maintaining appropriate safeguards for larger transactions. By refining these parameters, Jupiter can enhance the trading experience, strengthen its position in the market, and support its long-term growth.

Methodology

Our analysis uses live Jupiter trade data from August 17–25, 2025, a representative period with sufficient volume across major markets. For this window, we compare the actual fees collected with the simulated fees generated under the current parameter settings. This approach allows us to isolate the impact of parameter changes and evaluate how adjustments to the scalar would affect user costs.

Due to rounding effects and a recent update to the price impact function, simulated fees under the current parameters differ slightly from the actual collected fees. Therefore, all comparisons in this analysis are based on the simulated results to ensure consistency.

Results

Adjustment of the tradeImpactFeeScalar

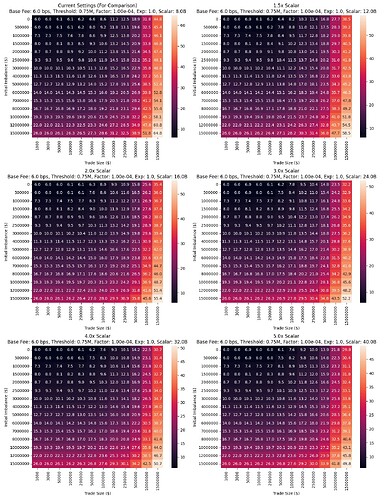

The heatmaps below illustrate the resulting price impact fees, and the accompanying tables show projected total position fees under the assumption of unchanged trading volume. We evaluated tradeImpactFeeScalars set at 1.5x, 2x, 3x, 4x, and 5x for each market relative to the current scalar value.

SOL

| tradeImpactFeeScalar | Simulated Total Fees ($)* |

|---|---|

| 1.250e9 (current) | 3,324,459 |

| 1.875e9 | 3,014,692 |

| 2.500e9 | 2,859,809 |

| 3.750e9 | 2,704,926 |

| 5.000e9 | 2,627,484 |

| 6.250e9 | 2,581,019 |

*These projections do not factor in any increase in trading volume, which we can reasonably expect if fees are lowered.

At the current scalar of 1.25e9, total fees are about $3.32M. Raising the scalar to 6.25e9 lowers fees to $2.58M, a drop of about 22%. SOL fees change the most when the scalar is adjusted.

ETH

| tradeImpactFeeScalar | Simulated Total Fees ($)* |

|---|---|

| 5e9 (current) | 1,655,063 |

| 7.5e9 | 1,533,820 |

| 10e9 | 1,473,199 |

| 15e9 | 1,412,578 |

| 20e9 | 1,382,267 |

| 25e9 | 1,364,081 |

*These projections do not factor in any increase in trading volume, which we can reasonably expect if fees are lowered.

At the current scalar of 5e9, total fees are $1.65M. With a scalar of 25e9, fees fall to $1.36M, down about 17%. ETH shows a smaller drop than SOL.

BTC

| tradeImpactFeeScalar | Simulated Total Fees ($)* |

|---|---|

| 8e9 (current) | 646,070 |

| 12e9 | 630,842 |

| 16e9 | 623,224 |

| 24e9 | 615,606 |

| 32e9 | 611,796 |

| 40e9 | 609,511 |

*These projections do not factor in any increase in trading volume, which we can reasonably expect if fees are lowered.

At the current scalar of 8e9, total fees are $646K. At 40e9, fees are $610K, only 6% lower. BTC fees barely move when the scalar changes.

Increasing the maxPositionSizeUsd

Jupiter currently caps maximum position sizes at the following levels: SOL: $5M, ETH: $10M, BTC: $10M. With the updated price impact parameters, it is now feasible to raise these limits without compromising risk controls. Chaos Labs recommends doubling the maximum trade sizes to provide greater flexibility for high-volume traders.

Recommendations

| Parameter | Asset | Current Value | Recommended Value |

|---|---|---|---|

| maxPositionSizeUsd | SOL | $5M | $10M |

| maxPositionSizeUsd | ETH | $10M | $20M |

| maxPositionSizeUsd | BTC | $10M | $20M |

| tradeImpactFeeScalar | SOL | 1.25e9 | 3.75e9 |

| tradeImpactFeeScalar | ETH | 5e9 | 15e9 |

| tradeImpactFeeScalar | BTC | 8e9 | 24e9 |

Summary

As an initial adjustment, Chaos Labs recommends increasing the tradeImpactFeeScalar 3x per asset and the maxPositionSizeUsd 2x per asset. This change is expected to make Jupiter’s fee structure more competitive while maintaining safeguards for larger trades. To properly evaluate the impact, we propose running this configuration for a two-week test period. At the end of this period, the results will be reviewed, and a decision will be made on whether to adopt the new parameters permanently or adjust further.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0