Introduction

Jupiter has established itself as Solana’s premier DEX aggregator, processing over $980B in volume since inception per DefiLlama and serving as the backbone for DeFi trading on the network. With their expansion into lending, staking, and perpetuals, plus the launch of Jupiter Mobile, Jupiter is positioning itself as Solana’s comprehensive DeFi operating system.

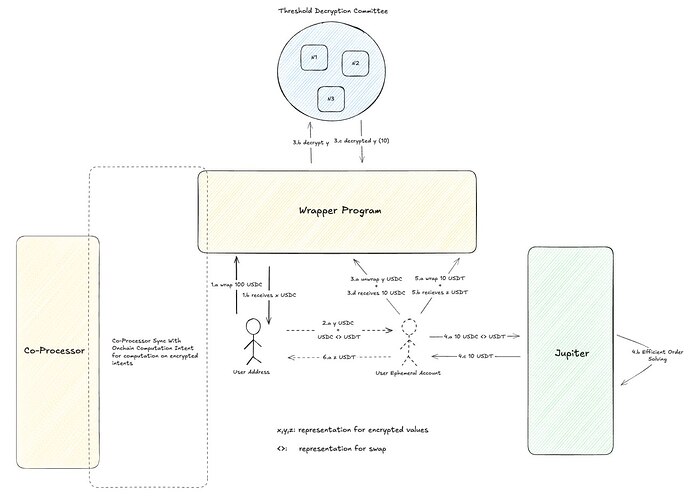

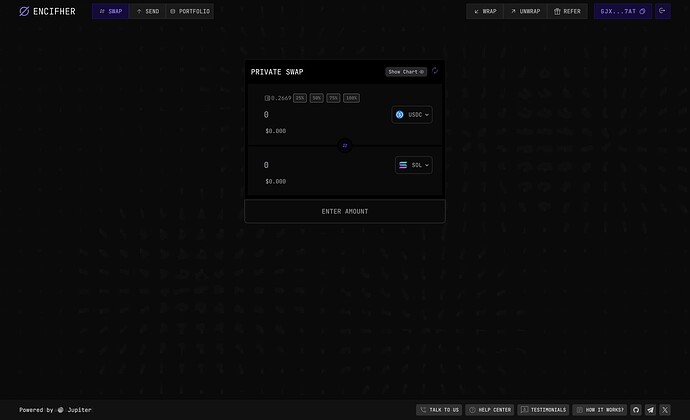

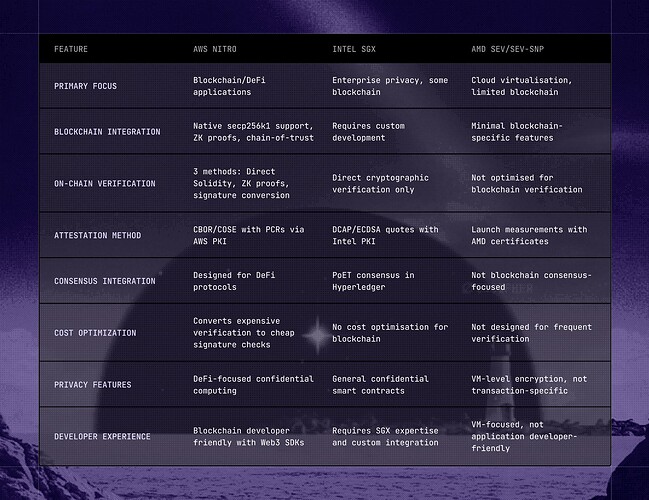

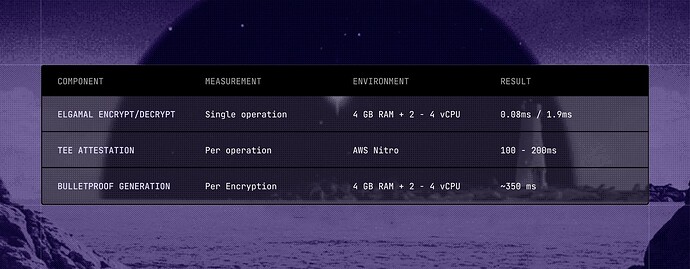

This research examines how Jupiter can capitalise on the next wave of growth by addressing a critical gap: the trade-off between privacy and security. Recent advances in threshold cryptography and Trusted Execution Environments (TEEs) now make it possible to add private trading to existing DEX aggregators without sacrificing composability or user experience. Unlike previous privacy solutions that required separate, isolated protocols, this approach lets traders keep their strategies confidential while still accessing Jupiter’s full liquidity and efficient routing capabilities.

The Privacy Gap in DeFi Trading

Jupiter’s transparency, while foundational to DeFi’s trustless nature, creates significant barriers for sophisticated traders:

1. Strategy Leakage TradFi traders choose CEXs because every trade onchain today reveals their strategy. A sophisticated arbitrage opportunity or technical analysis insight becomes public knowledge the moment it’s executed, eliminating the trader’s competitive advantage.

2. Copy Trading Exploitation Large trades when executed by profitable wallets or doxxed addresses are immediately visible and copied by bots. A memecoin trader who has made a lot of profit in their lifetime by launching coins will surely be copy-traded by users.

3. Institutional Barriers

The rapid evolution of DeFi presents significant opportunities for financial institutions to access new markets and users, particularly through the issuance and distribution of digital assets. Permissionless public blockchains offer unprecedented access to global markets with 24/7 availability and programmability, allowing issuers to benefit from consistent liquidity and broader user reach.

Despite these advantages, however, institutional participation on DeFi platforms is constrained by regulatory, risk management and privacy concerns. Regulated financial institutions remain subject to stringent requirements, including securities laws, anti-money laundering (AML), countering the financing of terrorism (CFT), strategy exposure and sanctions obligations. As a result, institutions often use private blockchain networks or gated systems that are blocked off from the broader onchain market.

-

Compliance Requirements: Banks and regulated institutions need to trade confidentiality for regulatory compliance

-

Fiduciary Duty: Fund managers cannot expose investment strategies to competitors

-

Corporate Treasury: Companies require confidential rebalancing and hedging operations

The Future of DeFi: Privacy as the Next Frontier

DeFi is shifting from centralized exchanges to on-chain solutions, offering transparency and composability. Yet, privacy remains a critical barrier.

Protocols like Jupiter already provide fast access to vast onchain liquidity, but without strong privacy guarantees, they miss out on:

-

Professional trading firms that drive significant volume and sophisticated strategies

-

Corporate treasury use cases for treasury management

The result: DEXs only account for ~18% of all crypto traded in 2025 according to The Block.

While the shift from CEX to DEX has been evident and vital; if more volume continues moving onchain, privacy will be essential infrastructure. Combined with evolving compliance, it will unlock greater adoption by traders, corporates, and developers with Jupiter leading the way.

What about compliance?

Our privacy-preserving architecture on Jupiter incorporates comprehensive compliance mechanisms to ensure responsible DeFi participation. The system integrates with leading compliance providers like CipherOwl and Chainalysis to conduct pre-transaction wallet screening against sanctions lists, terror financing networks, exploit addresses, and other high-risk categories. Flow-of-funds verification leverages data from Information Providers to determine asset origins, proactively restricting transactions associated with known exploits, OFAC-listed addresses, or illicit activities. This approach enables onchain anti-money laundering risk management while maintaining transaction privacy, particularly crucial given how major exploits often use decentralized exchanges for money laundering. Users experience seamless private trading while compliance checks operate transparently in the background, ensuring the venue remains safe for all participants. The threshold cryptography architecture enables selective regulatory access when legally required while preserving day-to-day privacy.

Our protocol supports selective disclosure through threshold key management, where no single entity can unilaterally access encrypted data. Compliance records are disclosed only through valid legal requests from recognised authorities, with all such actions logged and auditable. This design ensures encrypted transactions remain private from public observation while allowing regulators to access necessary information through proper legal channels. The framework balances user privacy rights with regulatory accountability, supporting institutional adoption by demonstrating that privacy and compliance can coexist effectively in DeFi infrastructure. This approach positions privacy as compatible with compliance requirements rather than adversarial to them, making it suitable for institutional Jupiter adoption while maintaining technical credibility.